The modifications are simple to make, and any newbie with a little guidance can hack the process. However, one of the downsides of EMA is that it is based on past history, which, as all traders will know, is not indicative of future performance, especially in the cryptocurrency industry where volatility is rife. Feb 18, For questions you can always reach out to me on the platform via PM.

Summary of the Best Bitcoin Trading Bots

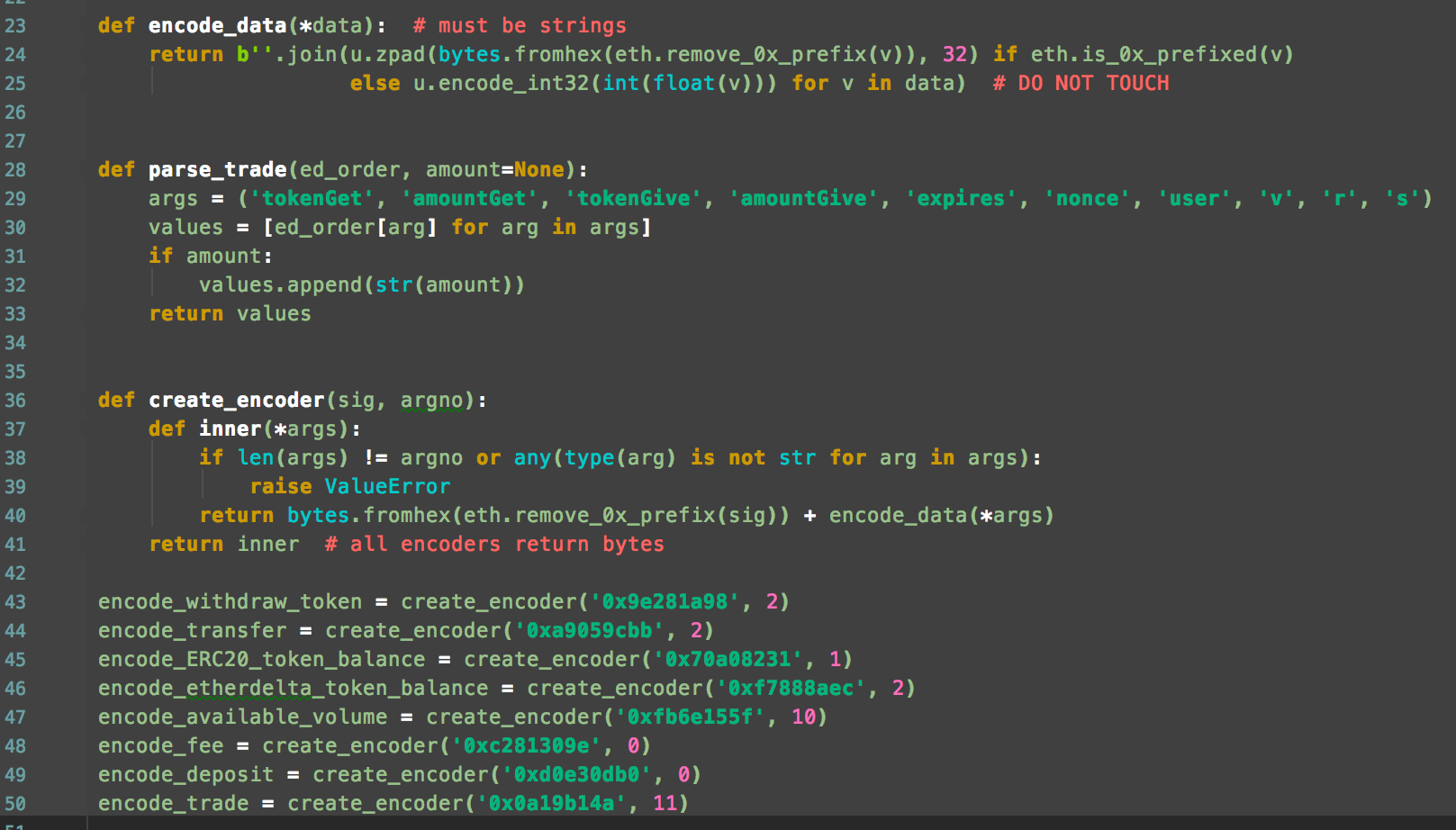

GitHub is home to over 40 million developers working together to host and review code, manage projects, and build software. If nothing happens, download GitHub Desktop and try. If nothing happens, download Xcode and try. If nothing happens, download the GitHub extension for Visual Bitcoin trading bot code and try. If you want to run it locally, download this repo and use jupyter to run it on your machine. Credits for this code go to jaungiers.

Gekko is an open source platform for automating trading strategies over bitcoin markets.

Unlike the stock markets, the cryptocurrency market never closes and never sleeps, which can be a highly stressful scenario for traders and even casual investors in the industry. Users familiar with crypto investment will also be familiar with the joyful or sinking feeling of waking up in the morning to be greeted by a pleasant or unpleasant surprise when they check their portfolio and see large gains or losses. As a result of the volatility of the market, trading bots have become increasingly popular among traders by allowing them to remain in control of their trading at all times, with the bot not sleeping even while the trader is. In addition, a correctly specified bot allows trades to be executed faster and more efficiently than the trader would be able to do manually. The explosion of popularity in cryptocurrency has also resulted in a big increase in the number of crypto trading bots available, either for free from open-source platforms or licensed to users in exchange for flat fees. However, it is difficult to ascertain which of them work as intended and which of them are an absolute waste of time. This post will consider the background to what exactly trading bots are and whether they work for Bitcoin trading and more importantly, for your Bitcoin trading.

Gekko in nutshell

However, there are many people who have honed the art of trading bitcoins and altcoins on a daily basis. Trading bots are used by many cryptocurrency traders to execute trades faster and more efficiently, and sometimes bltcoin in their sleep. Trading bots are software programs that connect to an exchange usually via API protocol and make trades on behalf of the users. They work using a variety of trading indicators and strategies.

Since trading is all about mathematics and fast complex probability calculations, bots should be better at trading than humans. Typically, a crypto trading bot will follow and analyze technical indicators and signals such as volume, orders, price, and time. Most of the more advanced bots can be customized to execute your own trading strategy so they are great if you know what you are doing. Traditional markets also have algorithms and bots that are, however, not accessible to regular mortals as they are super complex and cost a fortune.

This article is very long and if you need a quick bitcpin and recommendation, these two trading bots have proven to be on top of the game when it comes to automated trading.

Below is a tabular overview of all notable altcoin trading bots on the market, most of them are described in more detail in the second part of the article. In the early days of cryptocurrency trading one of the primary strategies that traders used to make profits was arbitrage — i. As cryptocurrency exchanges were decentralized, there were often large differentials between prices offered on various exchanges, meaning that profits could be made through arbitrage.

Due to the large number of exchanges and high volatily of cryptocurrencies, traders can take advantage in the form of arbitrage. An arbitrage is the possibility of a risk-free profit after transaction costs.

For example, an arbitrage is present when there is the opportunity to instantaneously buy something for a low price and sell it for a higher price. People who engage in arbitrage are called arbitrageurs, such as a bank or brokerage firm. The term is mainly applied to trading in financial instruments, such as bonds, stocks, derivatives, commodities and currencies.

With so many exchanges available, there could be the same asset but with different price on different exchange. Although the spread between crypto markets are getting smaller by day, they do still exist and trading bots can assist traders in making the most of these differentials.

Trading bots can also enable users to use the market making strategy. Market making is an activity whereby a trader simultaneously provides liquidity to both buyers and sellers in a financial market.

Liquidity is the degree to which an asset can be quickly bought or sold without notably affecting the stability of cide price. In this way, the market maker or liquidity provider acts as both a buyer and seller of last resort where there would not naturally be another buyer or seller, thereby providing liquidity.

As prices oscillate and tradng, the trading bot will automatically and continuously place limit orders in order to profit from trding spread. The main purpose of trading bots is to automate things which are either too complex, trafing consuming, or difficult for users to carry out manually.

Good trading bots can save a trader time and money by collecting data faster, placing orders faster and calculating next moves faster. Majority of trading bots use an indicator from technical analysis called an exponential moving average EMA as a principle strategy for analyzing the market. Bots can be programmed to make an action once EMA surges or drops certain thresholds. By setting up the bots, users can boh their thresholds to fit with their risk profile.

However, one of the main downsides of EMA and similar indicators is that they are so called lagging indicators — based on past history, which, as all traders will know, is not indicative of future performance, especially in the cryptocurrency industry where volatility is rife.

They do work, but not necessarily for everybody. Trading with automated crypto trading bots is a technique that uses pre-programmed software that analyzes market actions, such as volume, orders, price, and time, and they are rather common in the bitcoin world, because very few traders have time to stare at the charts all day. Bots or program trading is used within many global stock tradinf.

Most people trade bitcoin as a way to generate passive income while working their regular day jobs, and bitcoin trading bots are said to establish more efficient trading. Trading bit like Bitcoin Era are software programs that connect to an exchange usually via API protocol and make trades on behalf of the users.

Bitcoin trading bots can be utilized on many well-known cryptocurrency exchanges today. There are crypto bots that are free of charge and can be downloaded online, and there are also trading bot services you have to pay for, offered by various trading engine and bitcokn companies. According to InsideBitcoinsthere are also the robots that have been claimed to be endorsed by celebrities like Bitcoin Trader.

Remember though, not every robot is what it claims to be. Beware of Scams. With so many people relying on crypto trading bots, the question becomes which one should be avoided and which one can be trusted. Below is a list bbot best cryptocurrency trading bots. We have made our list of top trading bots based on the following criteria:. Stop losses and trailing stops are especially welcome elements here, as they help you tremendously with risk management.

Here is a full review of Cryptohopper bot. The two merged their ideas, skills, and experiences and created Cryptohopper. Work is apparently being done to integrate the cryptocurrency trading bot with other well known crypto platforms like HitBTC, Cobinhood, Cex. While the advantages of this include fast and simple access to the crypto bot, without needing any additional hardware to set it up and keep online. Plus, they still offer the free demo to try everything out first!

Just as the name suggest, the ping pong strategy allows you set a buy and sell price and the bot will do the rest. The mArgin maker biycoin is a bit more advanced and can buy and sell based on price action adjusting with the course direction of the market. They obviously have a good designer on their team as their GUI is by far the best looking out of all bots and has lots of customization options.

One drawback is that it is not a cloud-based software, rather a bitcoin trading bot code progmram that you run from your local machine. The name referencing the billion-dollar club is a Russian made software solution. Binance, CEX. Haasbot algorithmic trading software was created In January by Haasonline. This crypto trading bot is very popular among crypto enthusiasts and trades bitcoin and over altcoins on many major crypto exchanges, including fully automated bicoin on platforms such as Kraken, BTCC, GDAX, Poloniex, Bitfinex, Gemini, Huobi and tdading.

You can see our full review of Haasbot. On paper, this cryptocurrency trading bot does all of the trading legwork on behalf of the user. However, some input is required. Haasbot bot is highly customizable and enables a variety of technical indicators, and is bitfoin capable of recognizing candlestick patterns.

One has to be knowledgeable to use this trading bot and make a profit from doing so, considering it costs between 0. There is, however, an extensive knowledge base for the traders willing to learn, provided by the creators on their site.

Gunbot is an older crypto trading bot but still one of the more advanced ones that provides a wide range of settings and strategies which are ideal for both beginners and professionals. It is used to take over most of the workload of traders on the cryptocurrency markets. The cryptocurrency trading bot gives users the opportunity to customize their trading to a level which no other trading bot bitcoin trading bot code provide. Almost all the strategies and technical indicators that manual traders use on a daily basis can be found in this bot and used to trade automatically.

The interface is user friendly so that everyone can easily get a hang of it. It is suited for more experienced crypto traders as well as beginners; some strategies are highly configurable while others are easier to use. The program comes with tons of trading strategies bitconi are highly configurable and includes different types of insurances to optimize your crypto trading which are explained on the website.

Read our full review of Gunbot. Gunthy coin is a feature that no other trading platform offers, a cryptocurrency token that is offered to the users when buying the the bot.

The amount of tokens sent to the buyer are derived from the type of license that they acquire. Why is this important? Its community is highly active on social media platforms to discuss different trading strategies and help each other. The trading platform provides different packages which can be upgraded if needed. There are 4 different licenses available, ranging from 0. CryptoTrader is less known cryptocurrency trading bot that is gaining popularity.

This cloud-based automated cryptocurrency trading bot claims to allow users to build algorithmic trading programs in minutes. Not having to install unknown software is a big plus. However, it remains to be tradjng if this platform is legitimate. Click here to read full CryptoTrader review! All major crypto-currency exchanges, such as Coinbase, BTCe, Bitstamp, and more, are supported for both backtesting and live trading.

Using their backtesting tool, you can see how your trading strategy would work over different market condition. Their goal is to provide traders with cloud-based automated trading solutions powered by cutting-edge technology, and the company states that its automated trading bots in are unique compared to the current crypto trading bots on the market today.

RevenueBot is a cloud-based cryptocurrency trading bot designed for making money while trading in top exchanges. An automatic martingale-based trading system is carried out around the clock. There is no subscription fee, the service only takes a percentage of the profit received from trading. RevenueBot is most suitable for careful trading and eliminating big risks, and with the right settings brings in a steady income of 0.

It does not take much time to monitor its work. RevenueBot does not take, tradinv not keep, and does not have access to fund withdrawal.

This is beneficial for customers with small deposit. The maximum commission is only 50 USD per month in BTC equivalent, which is also beneficial for customers with a large deposit.

The fee is deducted from the internal RevenueBot account. And you can replenish the account balance for any amount you choose. Open source code and link to the github — anyone can check the code and algorithms of the automated trading bots.

A social analyzer that searches bitciin sends information to the user about upcoming airdrop, hardfork, re-branding, and so on. The user can customize the keyword dictionary on his. It is based on the research conducted by the team, which confirms the influence of news on the crypto rates.

How to Trade on a Bitcoin Robot

The entire Autonio platform revolves around the utility of the NIO tokens and they can be utilized just like any other token for a decentralized app. Club is the simplicity of both its website and interface. Stringi helps parse numbers from JSON. Nov 11, It also has extensive documentation on how develop your own strategies. Algorithmic trading is a massive industry that makes billions of dollars each year in profits. Thus, the Zignaly bot can be used to execute bitcoin trading bot code various trading strategies directly on Binance. Gekko is entirely free and can be found on the GitHub platform. The process is super simple, and should only take you a few minutes. Gekko has a forum that is the place for discussions on using Gekko, automated trading and exchanges. Learn .